Election year is here again, and so are many accompanying questions. I am here to debunk some myths and shed some light on what history can teach us.

During election years, it’s natural for investors to look for a connection between who wins the White House and which way stocks will go, especially given how polarized we are as a nation right now. Democrats are shouting, “If Trump wins, we’re going to hell in a handbasket,” while Republicans are shouting the same in reverse. Of course, past performance does predict future results, but when we look at data from 1929 through 2023, one thing is evident: it doesn’t matter who wins. The market is going to do what it’s going to do. But don’t take my word for it; let’s take a look.

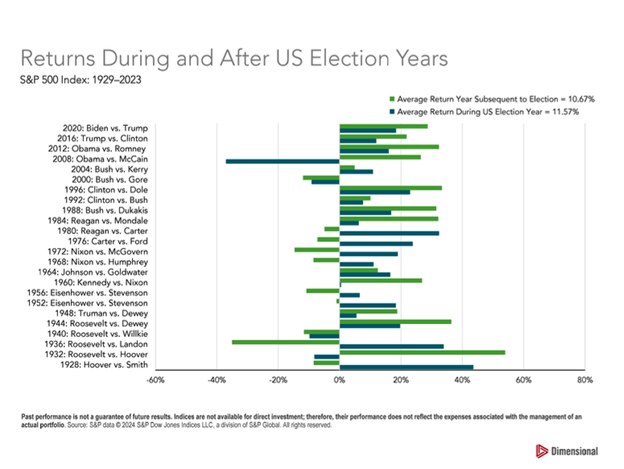

First, let’s consider the average annual returns in an election year and the returns in the following year. According to the Dimensional Fund graph below (Figure 1), the average return from 1929-2023 during a US election year has been 11.57%, while the average return in the year after the election has been 10.67%.

Figure 1. Returns During and After US Election Years, Dimensional.com.

What does this prove? Shareholders are investing in companies, not a political party. And companies still focus on serving their customers and helping their businesses grow, regardless of who is in the White House.

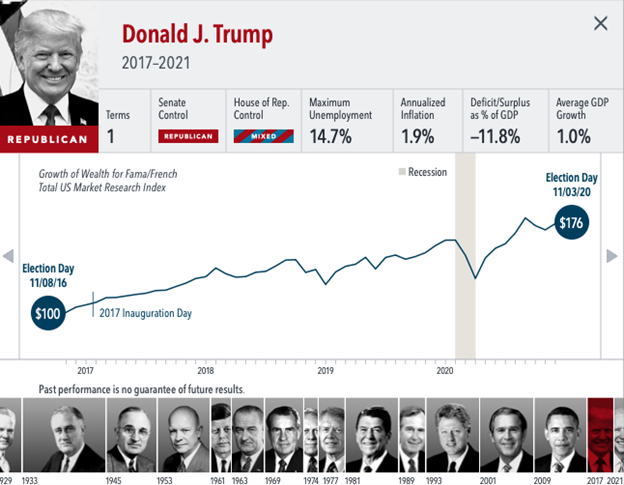

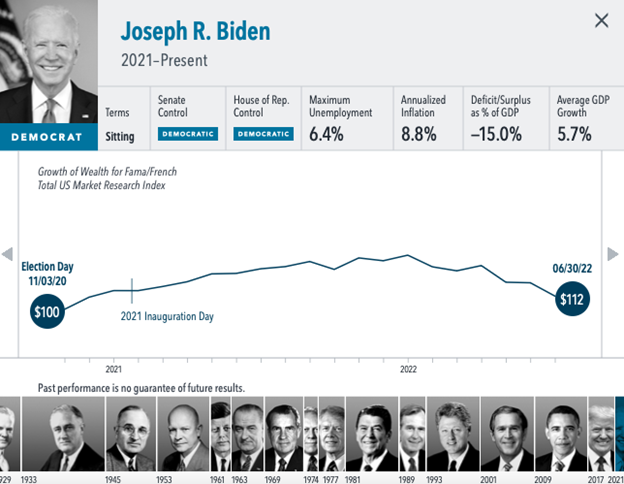

For further evidence, I always like to go back to previous elections to pull data that suggest our worries may be unfounded. Election year after election year, both the red and blue claim things will be horrible if the opponent gets elected. A quick glance at the charts provided by Dimensional Fund shows that, despite the drama in the media, this hardly ever rings true. Let’s take, for example, the 2016 election when Trump was elected (Figure 2). Look how the markets performed. The same goes for Biden after that (Figure 3).

Figure 2. Growth of Wealth for Fama/French Total US Market research from 11/08/2016 – 11/03/2020, Dimensional.com.

Figure 3. Growth of Wealth for Fama/Fintech Total US Market Research Index 11/03/2020 – 06/30/2022, Dimensional.com.

If nothing else, this data shows that market performance is not significantly affected by which party wins the election. Gridlock in Washington, where neither party has full control, has proven historically positive for the markets. This may be partly because gridlock reduces the chances of significant fiscal changes, allowing markets to operate with fewer disruptions. But regardless of the reasoning, we cannot deny what history has shown us. Markets will do what they will do, regardless of who is elected.

Overall, this data should serve as reassurance and a reminder that the President is just one of many factors that can impact markets. Others include interest rates, health crises, oil prices, natural disasters, tech advances, corporate activity, and congressional actions.

Because stocks have rewarded disciplined investors through Democratic and Republican presidencies, making investment decisions based on the outcome of elections or how you think they might unfold is unlikely to result in reliable returns. On the contrary, it may lead to costly mistakes, like missing the market’s best days.

So, what should you do now?

Remain Consistent: I do not believe the economy can be predictably forecast, nor can markets be consistently timed. Trying to dip in and out of markets based on current conditions is unlikely to provide any advantage and increases your chances of missing the market’s best days.

Don’t Jump Ship: The most efficient method of capturing the full premium return of equities is to remain fully invested at all times. Your portfolio and financial plan are built to ride out frequent, often significant, but historically temporary equity declines.

Focus on Long-Term Goals: Even during moments of volatility, reinvested dividends can buy more shares, and the power of equity compounding will continue to benefit investors in the long term. By focusing on long-term strategies and remaining invested, you can confidently navigate the market’s ups and downs, including those that occur during election years.

The Importance of a Financial Plan

This is just one of the many reasons a financial plan is critical. If you are a high-achieving professional or entrepreneur navigating the complexities of investing and wealth management, let’s talk. We’re accepting great new clients who are looking for a guide who can streamline their finances and give them confidence in their financial future. Use this link to schedule your initial conversation.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Stock investing includes risks, including fluctuating prices and loss of principal.

Dividend payments are not guaranteed and may be reduced or eliminated at any time by the company.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Caviness Wealth Management, LLC, a Registered Investment Advisor and separate entity from LPL Financial.