Over the last week, I’ve had a lot of questions coming in about the elections; and specifically, what effect the results will have on the market. Will the markets crash based upon which candidate wins?

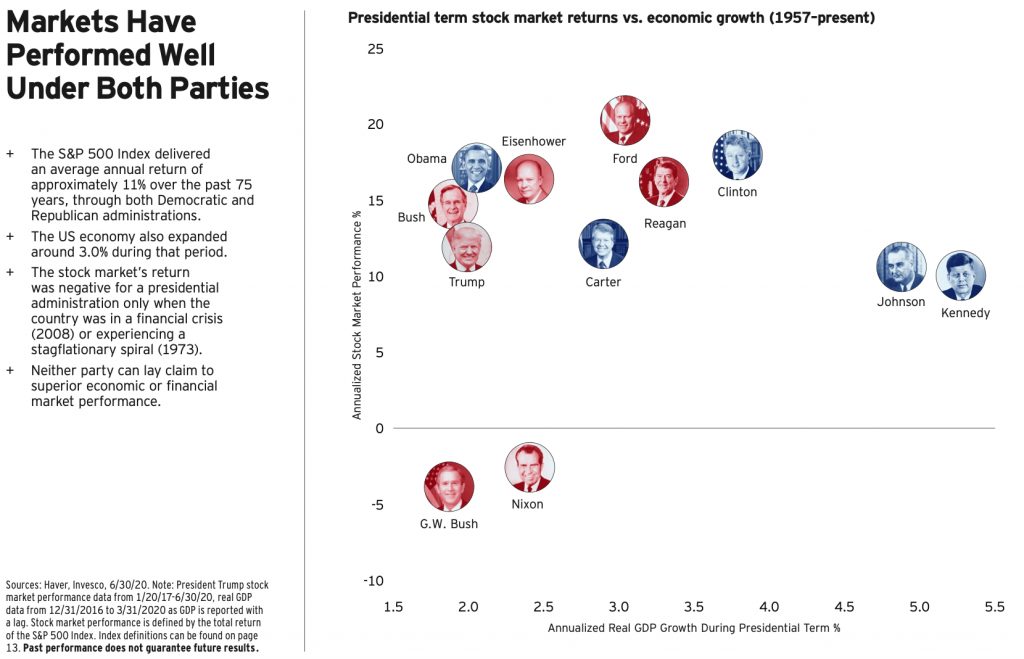

Does it really matter which political party occupies 1600 Pennsylvania? Most people tend to believe that stocks tend to do better when the White House is occupied by Republicans versus Democrats. I think part of that theory lies in the perception that Republicans are generally more business-friendly favoring tax cuts and lower regulations. However, as shown in this graphic from Invesco, the reality is that markets have performed well regardless of which party has occupied the Oval Office.

As investors, what should we do? Rather than focus on what has been said at the debates, the never-ending negative campaign ads, or what’s trending on Twitter; have an investment plan and stick to it. The direction of the market is still driven in the long run by fundamentals. And the near-term economic forecast gives reason to be optimistic that the recent global recession is over and for the current market trend.

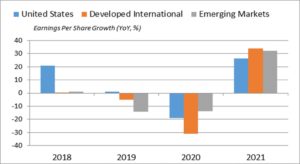

This chart from our LPL Research team showing expected earnings growth in 2021 indicates we are probably already starting the early stages of this economic recovery.

The reality is, elections DO matter; but not nearly as much as we tend to think when it comes to our investment portfolios. As my friend and LPL’s Chief Market Strategist, Ryan Detrick, recently said:

“Whoever wins this election is going to have the keys to a really good economy.”

And that’s where we should keep our focus as we approach the coming election.

Clients, don’t hesitate to contact me with any questions or concerns that you may have about your investments, the elections, or to simply grab a cup of coffee.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.