Q. I’m a teacher and plan on retiring in the next few years. I also have Social Security benefits from various jobs I have worked. I have been told that since I am a teacher I will not be able to collect my Social Security. Is this true? – J.B. in Texas

I hear this often from the educators that I work with, who have been told over the years that they can not get Social Security — even in cases where they have held employment and paid into the Social Security system. The reality is, you actually can receive both your Teacher Retirement & collect Social Security benefits, albeit at a reduced amount.

Social Security is complicated. Here’s a brief summary of what you should know.

Laws were enacted during both the Carter and Reagan administrations that changed the Social Security system aimed at curbing workers from “double-dipping” – collecting both a government pension and full social security benefits. The result were the implementation of the Government Pension Offset (GPO) and Windfall Elimination Provision (WEP). Which one applies to you, depends on your situation.

Windfall Elimination Provision

The WEP affects those workers who are covered by a government pension (such as Teacher Retirement) AND are also eligible for Social Security based on their own work history.

Simply put, the WEP is designed to recalculate your Social Security benefits when you also have a pension from employment in which you did not pay social security taxes.

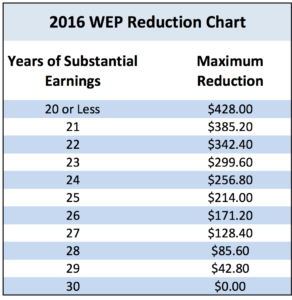

Source: Social Security Administration

A few things to note about the WEP:

– For 2016, the maximum monthly WEP reduction is capped $428.

– The WEP reduction can not be greater than 1/2 of your TRS pension.

– The monthly WEP reduction begins to decline after 20 years of substantial earnings and is eliminated at 30 years.

Government Pension Offset

The GPO affects those workers who are covered by a government pension and also eligible to receive Social Security benefits as a Spouse or Survivor.

The GPO will reduce the amount of your Social Security benefits by 2/3 of your Teacher Retirement.

The reality is, in most cases, a teacher who retires after a wonderful career would probably not receive any spousal benefits from Social Security due to the GPO. They may see a small monthly benefit of several hundred dollars in Survivor benefits.

Want to know how all of this affects your retirement?

Working with educators on a daily basis (in addition to being married to one) I understand how important it is that your Retirement planning begins today. The complexity of the Social Security rules and how they affect your benefits vary depending on your situation.

Want to know more? Need some additional guidance? Contact me today for a free, no-obligation consultation.